In one of its last acts in office, former Prime Minister Justin Trudeau’s government decided to give Canadians a break at the bank.

According to an order-in-council dated March 12, two days before Trudeau resigned, banks won’t be allowed to charge more than $10 if someone doesn’t have enough money in their personal accounts to cover a cheque or a pre-authorized debit.

Most banks charge non-sufficient funds (NSF) fees of $45 to $48 per transaction if an account holder does not have overdraft protection, which typically comes with its own monthly fee.

Banks will also be prohibited from charging NSF fees more than once within a period of two business days and in cases where the overdraft is less than $10.

To avoid bank account holders accidentally incurring an NSF charge, banks will also have to send an alert giving account holders at least three-hours’ notice that a payment exceeds their bank balance. If the account holder deposits money to cover the payment within that period, banks cannot charge the fee.

The new regulations will apply to personal and joint accounts but not to corporate or business accounts. They will go into effect on March 12, 2026.

The government predicts the measure will reduce NSF fees charged by Canadian banks by $4.1 billion over 10 years.

Finance Department spokesperson Marie-France Faucher said the order comes at the end of a process that began with a news release in 2023 as well as announcements in the 2024 budget and the government’s 2024 fall economic statement.

“This work included extensive consultations with consumer groups and banks to ensure that the regulations provided sufficient protection for consumers while being technically feasible to implement,” Faucher wrote in an emailed response.

The Canadian Banking Association, which defended NSF fees to the government, says its members will comply with the new rules.

“Now that the NSF fee regulations have been finalized by the Department of Finance, banks’ efforts will be focused on making the requisite system and process changes to comply,” said Maggie Cheung, media relations manager for the association.

Cheung said charging fees for payments that exceed bank balances helps Canada’s banking system and there are ways to avoid them.

“NSF fees encourage responsible banking behaviour and help maintain the integrity of the payment system,” she wrote in an emailed response. “To avoid these fees, customers can regularly monitor their account balances, set up balance alerts and consider overdraft protection services.”

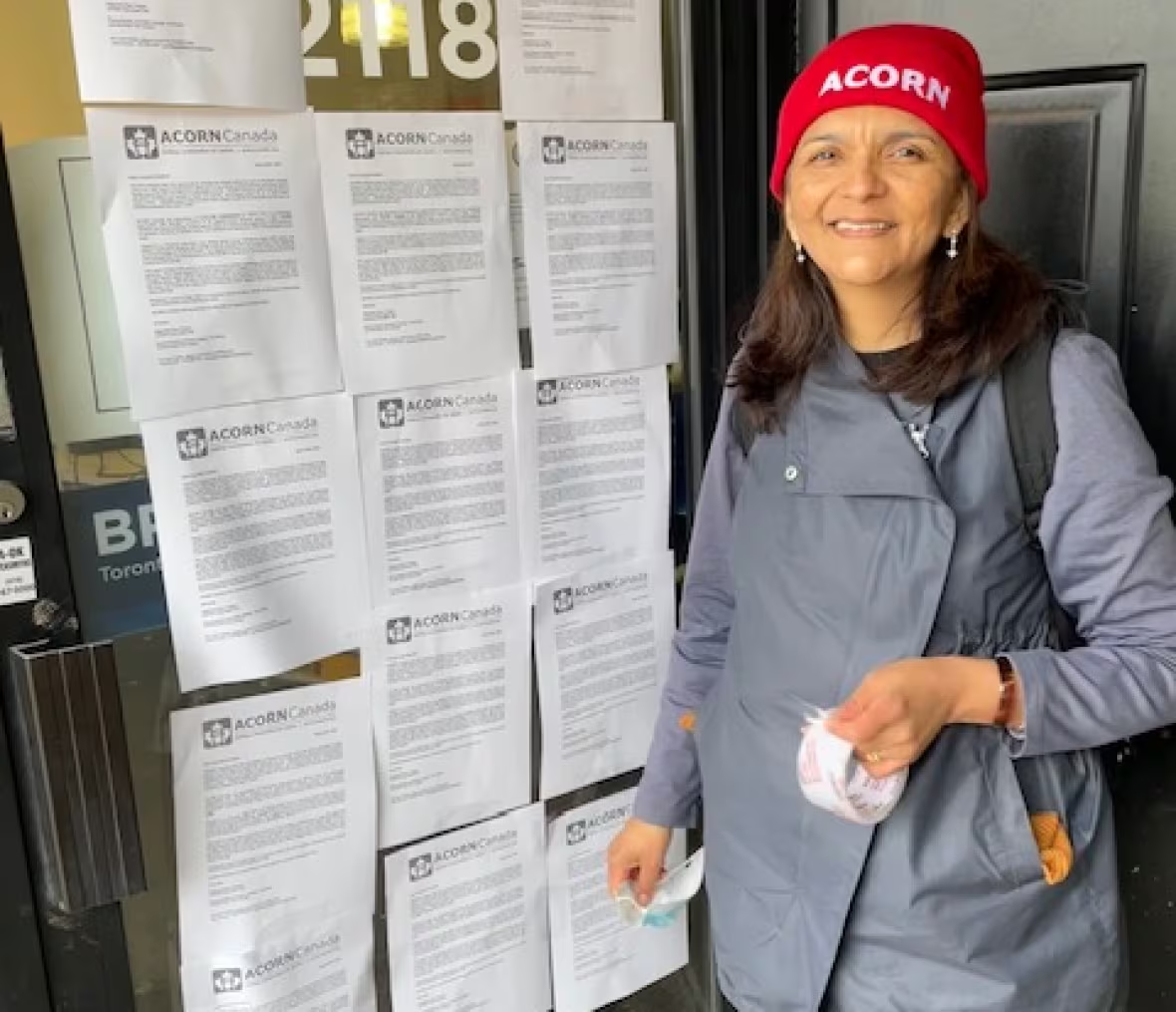

Alejandra Ruiz Vargas, president of ACORN Canada, which has argued that NSF fees disproportionately hit low-income Canadians, was thrilled the government had finally acted on its promise.

“We’re over the moon,” she said in an interview.

“This is something that we have been working for so long and so hard. Finally, the government has heeded our concerns.”

Vargas said even if someone is only $5 short to pay a bill or cover a cheque, they can get hit with a fee as high as $48 — money that they could have used for groceries or medicine.

“It is a window of hope for people,” she said of the change.

Vargas said ACORN would have liked the government to ban NSF fees, and have the change take effect faster.

However, in a 24-page regulatory impact assessment sent to ACORN, the Finance Department says it chose a $10 cap for a reason.

“A cap of $10 was chosen to balance the need to protect consumers from high fees with the need to maintain the integrity of the payments system by incentivizing consumers to honour their payments,” the department wrote.

The Finance Department estimates Canadian banks charged fees on 15.8 million NSF transactions in 2023, hitting an estimated 34 per cent of Canadians.

The assessment says NSF fees “represent a source of financial hardship for consumers. These fees disproportionately harm low-income Canadians and contribute to cycles of debt.”

It said those fees can quickly pile up “as a result of multiple declined payments,” and that the new regulations “will likely disproportionately benefit women, lone parent families, recent immigrants and Indigenous Peoples.”

While some banks offer a grace period, flexibility or overdraft protection for an account holder to cover the payment, not all customers are granted overdraft protection, the assessment points out.

The Finance Department says the new regulations will apply to 79 financial institutions across Canada.

Details of the new regulations are to be published in the Canada Gazette on March 26.