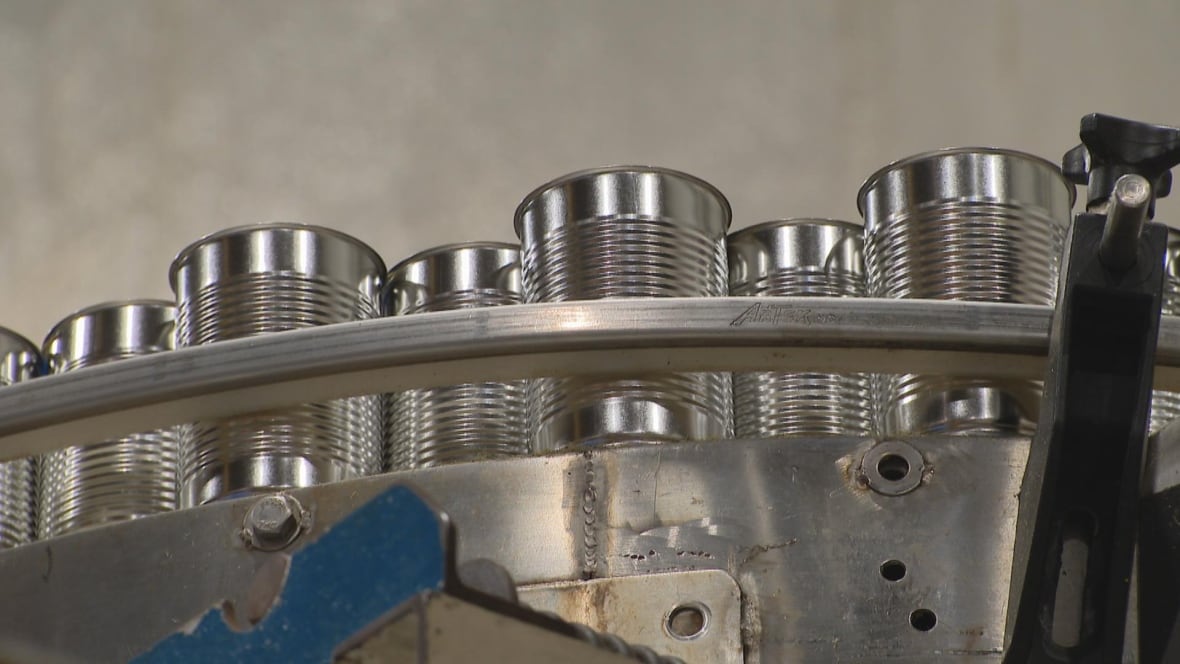

With U.S. tariffs still weighing on Canada’s steel and aluminum sectors, a Quebec-based food can manufacturer is expanding its operations — and bringing the American portion of its supply chain back home.

Ideal Can, a steel can maker based in Saint-Apollinaire, Que., is expanding its production capacity in Ontario next year, bringing it closer to clients like Sun-Brite Foods, Nortera and Weil’s Food Processing — and giving it a larger presence in a major food-processing region.

Established in 2008, the company began by importing cans from China for the Canadian food industry. Roughly a decade later, it started manufacturing cans domestically, first for maple syrup before expanding into other products.

“The independence from American [production] is very important at this moment,” said CEO Erick Vachon in an interview with CBC News. “So why [don’t we] use Canadian steel with Canadian food, and a Canadian can maker?”

As the Canada-U.S. trade war continues, Ideal Can is one of many domestic companies looking to move their supply chains back up north and maximize on the Buy Canadian movement. While some experts say that the trade war leaves little choice for those businesses, others say it might not be an economical one.

Cost increases began before trade war

The company’s Chatham plant will open in January in the old Crown Metal Processing factory. Six new production lines will bring its workforce up from roughly 35 workers in total to 100 over two years, costing $100 million. By 2028, the factory will produce an estimated 1.2 billion cans annually — well over the 800 million cans currently pumped out of its Quebec-based plant.

In addition to its expansion, Ideal Can is also reshoring a segment of its supply chain that was once only possible to have in the U.S., said Vachon. To that end, a Hamilton plant set to open in April will cut and varnish steel sheets and feed them to existing production plants in Chatham and Saint-Apollinaire.

Touting itself as the only all-Canadian food can manufacturer, the company’s sales have more than doubled since tariffs were imposed in March, according to Vachon.

The company’s recent pivot was mainly triggered by U.S. President Donald Trump’s tariffs on steel and aluminum imports this year, first at a rate of 25 per cent in March, then at 50 per cent on hundreds of products in June. Still, the cost of can production was ballooning well before Trump’s trade war began.

That was one of the factors that led Sprague Foods, a Canadian, family-run company that specializes in canned organic foods like soup, beans and chili, to go into business with Ideal Can.

“Before Ideal Can, there were no Canadian [food] can manufacturers. So we were left with having to source from the United States,” said Keenan Sprague, vice-president of Sprague Foods.

Pre-tariffs, one of Sprague Foods’ U.S. suppliers raised their prices by 76 per cent, and last year’s weak loonie weighed heavily on the company’s north-south operations.

U.S. President Donald Trump signed orders imposing 25 per cent tariffs on all steel and aluminum imports, including those from Canada. If that happens, Canadian businesses say consumers won’t be spared.

It was around this time that Ideal Can approached Sprague Foods “out of the blue,” Sprague said. His company began sourcing its cans from Ideal Can in the second half of 2024.

By the time Trump’s tariffs were imposed earlier this year, Sprague Foods was spared the worst of them — “the stars really aligned,” said Sprague. “We don’t know what’s around the corner, but so far we’ve been fortunate to avoid it.”

Given the inter-stitching of Canada’s supply chain with that of the U.S. and Mexico, “we’ve seen a fragmentation of the North American market” since the trade war began, said François Desmarais, vice-president of trade and industry affairs at the Canadian Steel Producers Association.

“It makes sense business-wise to resume producing some of those goods that we let America build, produce for the full market. So now we have to manufacture in Canada for the Canadian market.”

Reshoring not always feasible

However, some experts question how economical it is for Canadian companies to reshore the U.S. segments of their supply chain back onto northern territory.

“It could be advantageous for manufacturers to move to Canada as long as they manufacture for the Canadian market,” said Jean-Charles Cachon, a professor emeritus of management at Laurentian University in Sudbury, Ont.

That’s largely because the value of the Canadian dollar is falling and will likely continue to fall over the next few years as the price of oil drops against the dollar and the euro, he said.

“I know that it’s been discussed in some circles that there are some areas of the economy where it could be advantageous to bring back production to Canada.”

But he cautions that the economic upsides of bringing production back up north will largely depend on the type of steel required by a given company.

“The thing is, we talk about steel with the idea that it’s a generic product. In fact, steel companies and manufacturers manufacture thousands of different products every year,” he said, many of them requiring different metal mixes generated by specific software.

“So in all those plants — which are extremely costly to build — that’s the main issue.”