Twice, Det. Sgt. Ray Aceti was at the right place at the right time to stop a scam victim from sending thousands of dollars to a fraudster through a crypto ATM.

The first save was about five years ago, with a recent immigrant who’d taken out his life savings.

“He was so overwhelmed by being on the phone for several hours with this fraudster who had coached him basically right to the brink of putting that money into the machine,” said Aceti, who works for Niagara Regional Police.

“I said, ‘If the money goes into the machine, you’ll never see it again.'”

The second time was in January, as Aceti wrapped up a crypto ATM awareness campaign that saw him and officers install fraud warning posters beside 85 machines in the area. Since 2020, scam victims have reported more than $3.1 million in fraud losses through crypto ATMs to Niagara Regional Police and nearly $1.4 million of that was reported last year.

Aceti’s work is among the few steps CBC News found Canadian authorities taking to tackle this problem during the investigation for this series, Feeding Fraud: The Crypto ATM Problem.

In part of three of CBC’s series Feeding Fraud: The Crypto ATM Problem, we look at why Canada doesn’t have industry-specific measures to regulate Crypto ATMs, when some peer countries have effectively banned them or introduced regulations

Other police services like the RCMP and Ontario Provincial Police (OPP) have also put up warning posters. But when it comes to oversight, there are no regulations specifically designed for this industry, which has seen more than $1 billion in transactions across the country so far this year.

Though they operate legally, Canada’s financial intelligence agency, FINTRAC, has determined that crypto ATMs have become the main method fraudsters use to get money from scam victims — and several of Canada’s peer countries cracking down on the industry with targeted regulations in recent years.

“My concern is the number of victims,” said Aceti. “There definitely needs to be much tighter regulations.”

Others in law enforcement, fraud victims, former crypto ATM employees and a former operator who spoke to CBC for this series echoed those sentiments — with a few going further and calling for an outright ban on the machines.

“The easiest way to fix this problem, in my personal opinion, would just be to eliminate them,” said Det. David Coffey, with Toronto police’s financial crimes unit. “Other countries have done it.”

Other jurisdictions take action

The U.K. effectively banned crypto ATMs by creating a licensing infrastructure in 2021 that hasn’t issued any licences to operators. New Zealand is proposing a ban on the machines and Australia introduced daily transaction limits this summer following a major investigation from its financial intelligence agency and police services.

South of the border, half of U.S. states have proposed or implemented laws to impose measures like daily transaction limits per customer, caps on transaction fees, and requirements that operators issue refunds to scam victims.

Right now, none of those approaches seem to be on the table in Canada.

CBC News requested interviews with both Finance Minister François-Philippe Champagne and FINTRAC to ask about what (if any) action they were taking.

Neither request was granted. Asked on Parliament Hill about the lack of specific regulations in the wake of the FINTRAC report, Champagne did not address the agency’s finding, but told CBC the government is looking at all options to prevent financial crimes.

“This is something we’re looking at very carefully and very seriously,” said Champagne.

A Department of Finance official said in a statement that they continue to assess the risks of virtual currency and “evaluate measures that could be considered to mitigate them, without unduly limiting innovative opportunities.” Generally, it also pointed to FINTRAC’s work collecting and distributing intelligence to better fight fraud and money laundering.

FINTRAC did not answer CBC’s questions about its internal report. Instead, it said it will continue to fulfil its mandate under Canada’s federal anti-money laundering law to enforce “registration and compliance obligations for cryptocurrency ATM operators.”

The companies are classed as a “money services business,” a designation that also includes foreign exchange dealers, regular ATMs and money-transfer services, like Western Union.

Under the existing federal law, all of those businesses are required to register with FINTRAC, submit reports for large cash transactions, suspicious transactions and to follow know your customer (KYC) rules — such as verifying a person’s identity — for transactions over $1,000.

17 U.S. states now have specific rules

Canada has the second most crypto ATMs in the world with about 3,600, behind only the U.S. which has roughly 30,945 machines, according to Coin ATM Radar, a website that maps out the machines.

But there’s a cost for their convenience. Crypto ATMs generally take a 15 to 30 per cent cut of transactions in fees compared to online cryptocurrency exchange platforms, whose fees often range from two to five per cent.

Last year there were nearly 11,000 fraud complaints involving crypto ATMs in the U.S., with victims reporting losses of $246.7 million, according to the FBI’s internet crime report. Half of the country’s states have proposed specific measures to try and prevent that, and 17 states have implemented those laws so far.

New York’s licensing system has effectively banned the machines, by not issuing licences to these operators like the U.K.’s approach. But most of the states have proposed specific regulations on the industry that still allow the machines to operate.

In June, Maine implemented a law that former operator Marc Grens considers the gold standard. The state’s regulations include capping fees at three per cent, setting daily transaction limits of $1,000 a customer and requiring operators to issue refunds to fraud victims under certain conditions.

“Maine has basically crippled the industry by saying, ‘You can’t make more than three per cent, because the use case shouldn’t be anybody paying more than three per cent,” Grens said.

Grens shuttered his 1,400-machine operation a couple years ago because he believes the industry wouldn’t be profitable without fraudulent transactions. He’s now working as a subject matter expert on crypto ATM bills for various states.

The majority of the laws proposed, or implemented, in the U.S. involve daily transaction limits and refunds for fraud victims under varying conditions.

Australia’s top crypto ATM users mostly fraud victims

Australia also introduced a $5,000 daily transaction limit per customer in July. The move came after a joint investigation from its financial intelligence agency, AUSTRAC, and police services found that the vast majority of customers putting the most money into crypto ATMs were fraud victims.

“Some of the police were able to go out, meet these customers, and actually test whether or not our suspicions about the risks of them being victims of crime were actually true,” said Tim Lear, head of legal and enforcement at AUSTRAC.

“Unfortunately, a very large percentage of those customers, over 80 per cent of the people they visited, they confirmed, were victims of fraud or scams.”

In Tasmania, all of the top 15 crypto ATM users turned out to be scam victims and they collectively lost about $2.5 million.

“It has lifelong impacts on many of our victims,” said Det. Sgt. Paul Turner with Tasmania Police’s cyber crime investigation unit. “It’ll result in them having to sell assets, become dependent on government payments for the rest of their lives.”

Operators open to some regulations

So what do crypto ATM operators think about calls for industry-specific regulations?

CBC News requested an interview with the top six operators in Canada for this series, which altogether operate at least 200 machines. Only one operator agreed to an interview, and two others sent written responses.

Sam Mokbel, who runs the third largest operator in the country, supports some new regulations like limiting transactions for first-time customers or putting a hold on larger purchases until an operator talks to the customer. But is against others, like putting a cap on transaction fees.

“This is a very expensive business to run,” Mokbel said, president of HODL. “Placing a hold on a transaction and asking the operator to refund is okay, but not after two weeks or three weeks. You can’t hold the money for that long.”

Two other operators, Bitcoin Depot and CoinFlip, said they support some regulations to protect consumers, but didn’t specify what those measures would look like.

Given there are no imminent plans for new regulations in Canada, law enforcement officials say public education is key — like spreading the word that government officials and police will never ask the public to send cryptocurrency.

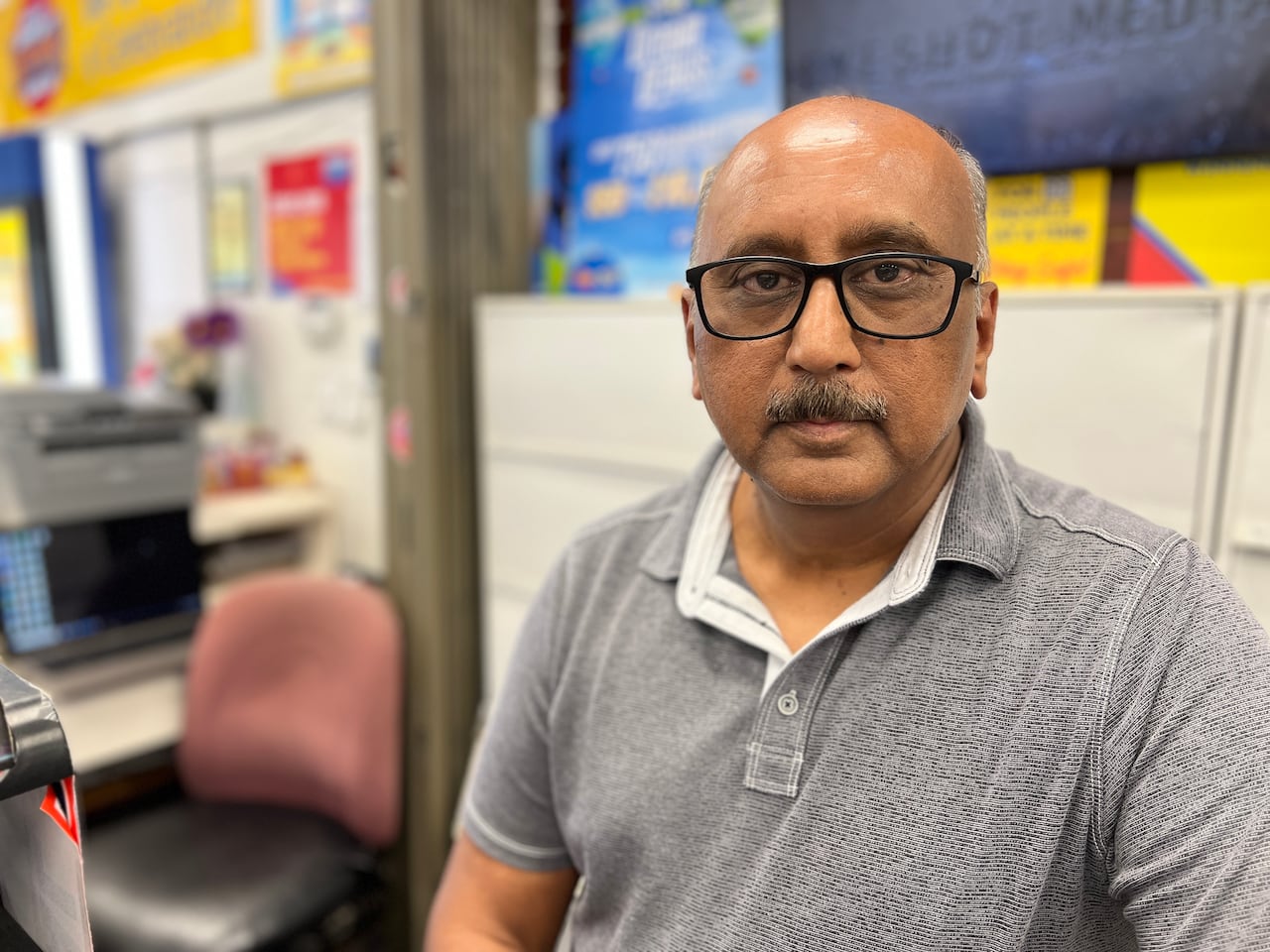

Det. Aceti’s awareness campaign included talking with store owners like Ashok Malaviya about what to look out for when customers use the crypto ATM in their shops.

“If somebody is on the phone and they are listening and they are struggling with the machine, that means there is something wrong,” said Malaviya, who owns a variety store.

“I always ask them, ‘are you sure you know what you are doing?'”