Delphine Winton just recently moved into an apartment by Casa Loma built in 1936 — and she’s not looking back.

During her hunt for a new space, the 22-year-old student was strictly looking for older buildings, choosing to stay away from the sliding glass doors, lack of “character” and odd floor plans she’s seen in newer condos.

“God forbid you have enough room to put a dining table in,” she told CBC Toronto.

Winton isn’t the only Torontonian opting out of moving into new builds — for reasons ranging from a lack of rent control to poor layouts — at a time tenants are increasingly gaining leverage in the market.

Nicole Luongo, a 36-year-old policy analyst who just signed a lease for a unit in Little Portugal that’s “pushing 100 years old,” says she found the sterility of new units off-putting.

“[I] was also looking for an adequate size, a layout that felt livable versus claustrophobic,” she said.

For her, the affordability of an older place was also a major factor.

New purpose-built rental units are taking longer to lease because of increased competition from the secondary market, according to a July report from the Canada Mortgage and Housing Corporation (CMHC).

Though CMHC data shows rent prices in older buildings are starting to catch up with new ones, affordability in tight, expensive markets deteriorated so much that many renters are settling for modest savings “by choosing older stock,” according to the CMHC report.

‘Who are these condos for?’

Aside from wanting a bigger layout, having rent control is a must for Samantha Dangubic as she looks for a bigger place to live with her partner.

In Ontario, landlords in buildings that were first occupied before Nov. 15, 2018 are limited by how much they can raise rent every year.

“Some friends who did happen to try out the newer builds, they were hit with like a $500 increase,” Dangubic said.

“No one is able to pull that off nowadays, which really makes me curious who are these condos for?”

Over half (55.2 per cent) of Toronto condos built from 2016 to 2020 were used as investment properties as of 2020, according to a study from the Canadian Housing Statistics Program.

That figure drastically decreases for older buildings: 40.1 per cent for condos built from 2001 to 2015 and 24.1 per cent of condos built in 2000 or earlier.

Apartments increasingly being viewed as investments rather than homes to live in is a big reason behind poor layouts, according to David Fleming, a Toronto-area broker and real estate blogger.

He said in the past decade, developers started shrinking the size of their condos, aiming to squeeze in as many units as possible while keeping prices the same, as building costs have ballooned.

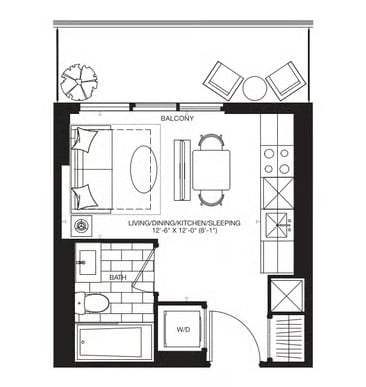

While pointing to a floor plan of a new 267 square foot condo, he said “this was only built so that an investor could buy it, so the developer could get pre-construction financing. And that is why these units exist.”

“I think by the time you lay out your bed, which right now is a pull out couch, you could probably open the fridge with your toes,” Fleming said.

“I think it really speaks to the fact that we’re living in a literal shoe box.”

Toronto condos built from 2016 to 2020 are about 400 square feet smaller than ones built between 1971 and 1990, when looking at their median size, according to Statistics Canada — and fewer investors are rushing to buy them.

Only 53 new condo units were sold in Toronto in September, new BILD data shows.

Poor market gives renters more options

The rental market is also changing. As of October, the average rent for unfurnished one-bedroom units in the city was about $300 less than it was in October 2023, according to Liv Rent, a Canadian online rental platform .

The state of the market means renters can be pickier with the space they choose to live in, said Toronto real estate agent Alex Zhvanetskiy, who has also noticed renters opting out of some newer builds, citing lack of rent control and poor layouts.

“They’re moving a lot more cautiously,” he said. “They don’t have to act as quickly. They have a lot more options.”

As GTA condo vacancies reach record highs, many landlords with small portfolios have been left scrambling — or leaving the industry altogether.

Some landlords for new apartments are trying to offer incentives, like one month of free rent, to make sure they’re getting tenants in the door. But do developers care whether renters like what they build?

For Fleming, it’s a straight no.

He says developers can only build what they can sell pre-construction, and larger units are just not as popular among investors, who often look to buy the cheapest units possible.

“If the city were to step in and say no more 267 square foot condos, I do not think, in fact, I know — nothing would get built in Toronto,” Fleming said.